Goboarding for industries:

Financial Services

Comprehensive KYC and Fraud Prevention

for Financial Services

In highly regulated industries like banking, wallets, crypto, credit, and other financial institutions, managing fraud risks and ensuring compliance is critical to avoiding legal and financial sanctions. Our automated KYC solution offers an end-to-end identity verification system that meets global KYC requirements with customized workflows tailored to your unique needs.

Empower your business with seamless digital onboarding.

Our solution combines:

Biometric facial recognition

Biometric facial recognition

Document verification technology

Document verification technology

AML risk detection (for KYC)

AML risk detection (for KYC)

Advanced AI-driven methods

Advanced AI-driven methods

Ensure a robust identity validation.

Our seamless verification processes reduce drop-off rates, helping to expand your customer base while minimizing fraud.

By automating OnBoarding and KYC processes, our solution enhances compliance efforts and effectively protects against fraud, allowing you to balance risk management with a smooth customer experience.

Optimize Compliance, Fraud Prevention and User Experience

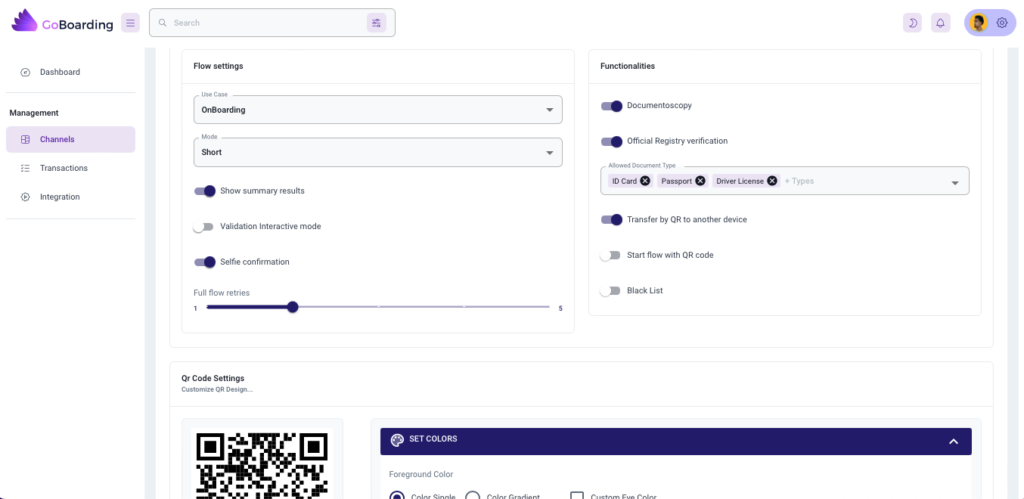

Select the right features to create flexible processes tailored to different user segments. Maximize pass rates by applying the appropriate checks at the optimal times.

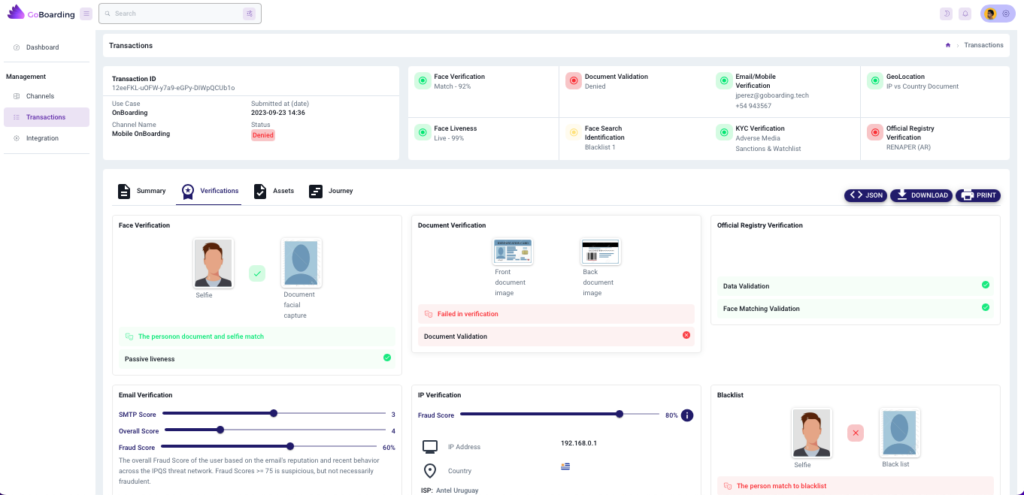

A unified platform to take action

Your fraud team will have a reliable platform to view your onboarding and KYC processes, with all the relevant information to be able to take action against possible fraud. The potential of artificial intelligence at the service of your team

Our functionalities at your service

Sign Up

Email Risk Assessment

Email Risk Assessment

Phone Risk Assessment

Phone Risk Assessment

Device Intelligence

Device Intelligence

Identity Verification

ID Verification

- Id Auto-capture

- Verification of document numbers and date formats for accuracy

- Face capture & extraction

- Signature capture & extraction

- Barcode scanning & extraction

- Data match (data consistency)

- Age verification

- Document validity (expiry date) check

Automated document appraisal

- Liveness verification (Hand presence)

- Advanced data integrity verification

- Screen detection (detects screen-presented documents)

- Face photo tampering detection

- Barcode authenticity checks

- Black & white photocopy detection

- Color photocopy detection

Liveness and Face match

- Passive liveness detection (identify spoofing attempts based on selfie)

- iBeta/NIST Level 1 and Level 2 PAD Compliant

- Face matching using ML and computer vision technologies

- Lowest true match rate of 99.94816% across six demographic groups defined by skin tone and gender

- Privacy by design

Location Verification

- IP vs Country Document

Official Registry Verification

- Data Verification

- Face Matching Verification

BlackList

- Face Search Identification in BlackList of previous failed onboardings

Our solutions for the financial industry

Loan Origination

Verify the identity of applicants through a loan application process.

Digital Wallet Onboarding

Ensure secure user authentication during onboarding of digital wallet services.

Digital banking

Maximize conversion with fintech identity verification and minimize fraud risks with custom workflows for each user segment

Payment Processing

Perform verifications of users who make payments and transactions within financial platforms.

Crypto payments

Maintain high pass rates with a seamless, secure, and global verification solution for Crypto users